Rates Down After Awful Nov Jobs Report: +50k Private Sector Jobs, 9.8% Unemployment (CHARTS)

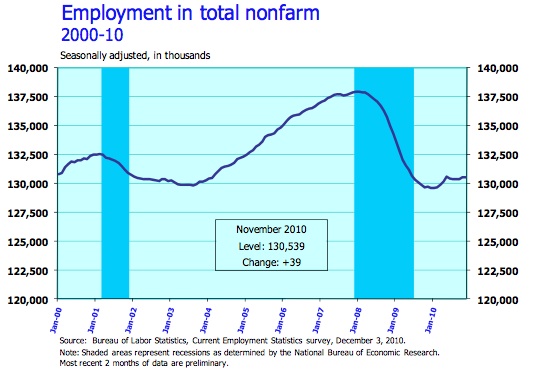

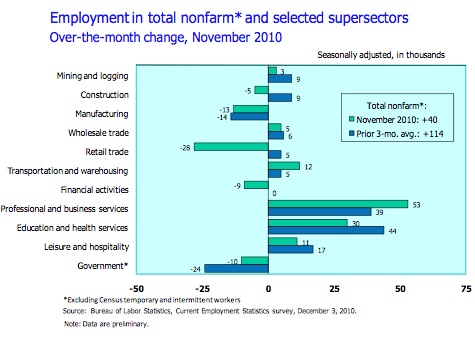

Following this morning’s much worse-than-expected November jobs report, mortgage bonds are up 47 basis points, which brings rates down by about .125% so far today—when bond prices rise on a rally, rates drop. [UPDATE 3:20 ET: rates up again as 47bps gain goes to zero] The report showed 50,000 private sector jobs were gained, so the economy has now added 1.2m private sector jobs this year. Here’s why the report was so bad: non-farm jobs estimates called for +150k (vs. 39k actual) and private sector jobs estimates called for +140k (vs. 50k actual). BLS also reported that 15.1 million people are unemployed, which brings unemployment to 9.8%, up from 9.6% last month and up 4.9% since the recession began in December 2007. One optimistic part of the report is that forced-into-part-time workers dropped about 200k. Charts and more commentary below.

CHART 1: PRIVATE SECTOR JOB GAIN/LOSS JAN 2008 TO NOV 2010

There are now 9.0 million people who would like to work full time but are working part time because their hours have been cut or they can’t find full-time jobs. This forced-into-part-time-work category is up 4.1m million since January 2008 but down about 500,000 since September. This is an improving trend, but 9m is still large enough to make economic recovery questionable: job loss and unemployment statistics show that these 9 million people are employed and therefore not in the job loss category, but because of their job status these 9 million workers aren’t likely to be consuming at normal levels.

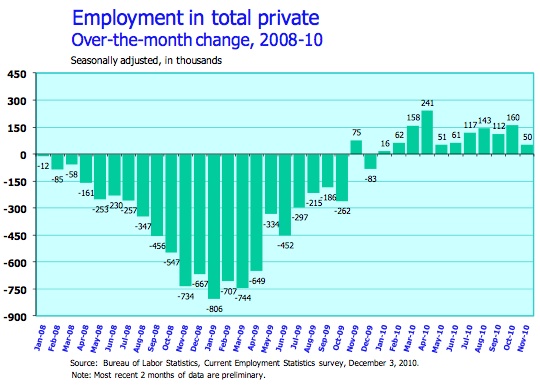

CHART 2: NOVEMBER 2010 JOBS BY SECTOR

CHART 3: JOB LEVELS JANUARY 2000 TO NOVEMBER 2010